CBO: U.S. debt held by the public to nearly double in 10 years

Back in 2017, when she was Federal Reserve Chair, Janet Yellen said the following to what was then a $20 trillion national debt:

I would simply say that I am very worried about the sustainability of the U.S. debt trajectory. Our current debt-to-GDP ratio of about 75 percent is not frightening but it’s also not low.”

“It’s the type of thing that should keep people awake at night.

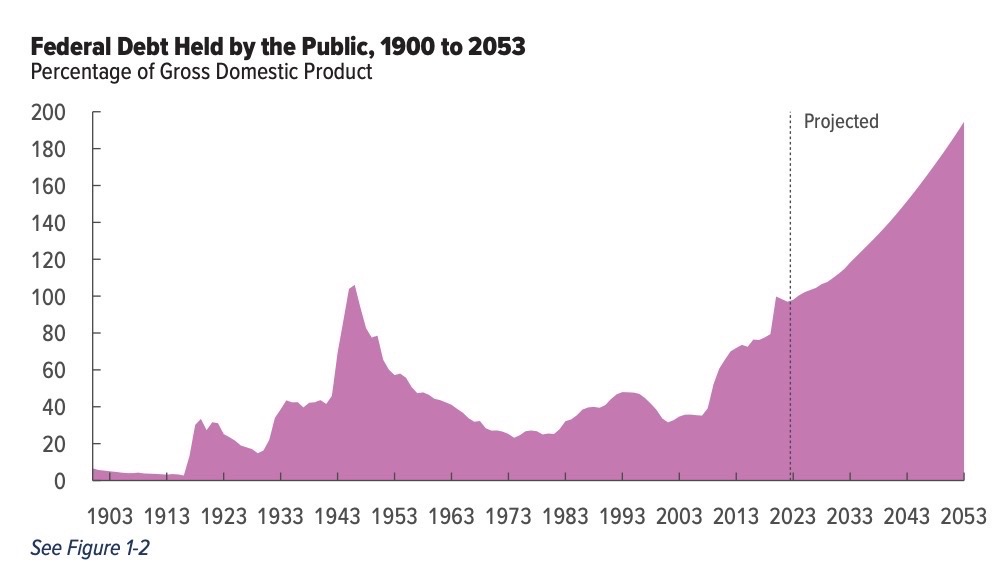

Since then, the situation has only gotten worse. In fact, between 2017 and 2022, the national debt has grown by $11 trillion, reaching $31 trillion in October of last year. And of the two components that make up total debt, debt held by the public — which makes up about 70 percent of total debt — has seen a higher growth, rising from under $5 trillion in 1997 to $24 trillion in 2022.

CBO predictions

Unfortunately, according to the Congressional Budget Office (CBO), this trend is not slowing down anytime soon. CBO estimates that by 2033, debt held by the public will reach $46 trillion — almost double what it was in 2022.

While currently, federal debt held by the public is 98 percent of GDP, it will be surplus US total annual GDP by 2033. And in 30 years, debt held by the public will make up nearly double our nation’s GDP.

Mandatory spending on social security and medicare as well as spending on interest mainly to blame

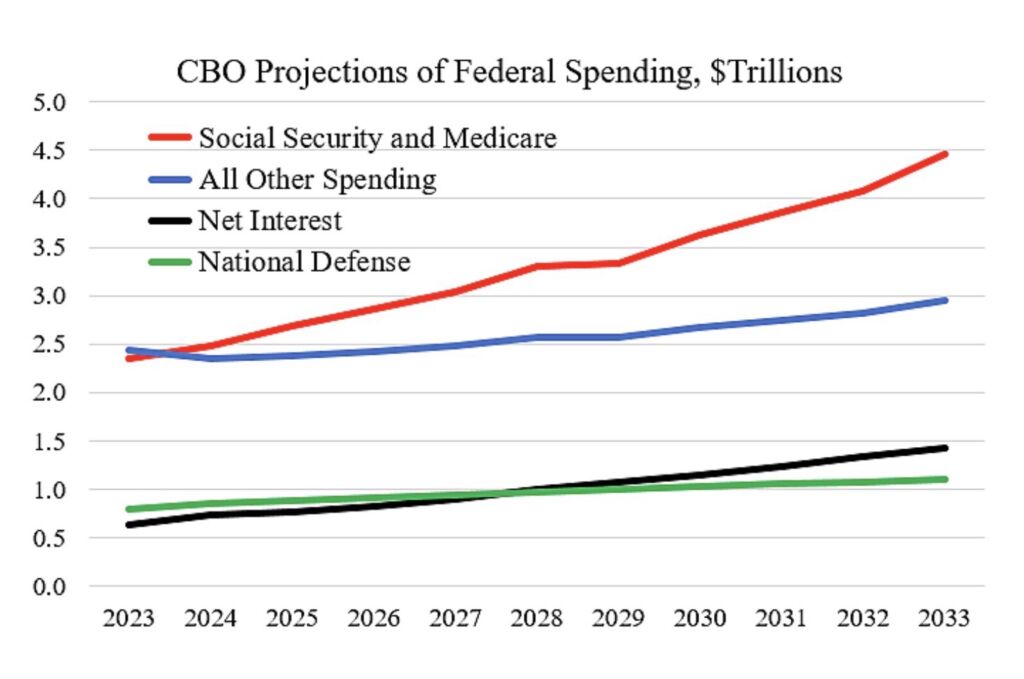

According to CBO, growth in spending on Medicare and Social Security will be the main driver of growing deficits and debt.

The combined cost of the two programs for the elderly is projected to leap from $2.35 trillion in 2023 to $4.46 by 2033. By then, spending on the two programs will be four times higher than spending on national defense.

The CBO also expects interest paid on the national debt to grow, further contributing to rising deficits and debt. Overall, CBO estimates that between 2023 and 2033,

the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt