Why the FTC’s lawsuit against Amazon is bad for consumers

The Federal Trade Commission (FTC) is seemingly at war with Amazon. In September, the FTC, along with 17 state attorney generals, filed a lawsuit alleging that Amazon engages in actions that allow

it to stop rivals and sellers from lowering prices, degrade quality for shoppers, overcharge sellers, stifle innovation, and prevent rivals from fairly competing against Amazon.

This is the fourth lawsuit that the FTC has filed against Amazon this year. Another suit filed in June accused Amazon of tricking consumers into signing up for Prime membership and making it hard to cancel.

According to FTC, among other things, Amazon biases search results in favor of its own products. Amazon also worsens customer experience on its app by bombarding customers with paid advertisements and junk ads. Furthermore, Amazon charges “costly fees on the hundreds of thousands of sellers that currently have no choice but to rely on Amazon to stay in business.” And since sellers who use Prime must guarantee certain shipping standards that match or surpass that of Amazon’s Prime, they are coerced into using Amazon’s Fulfilment By Amazon (BFA) service, raising costs for sellers.

By filing the lawsuit,

the FTC, along with its state partners, are seeking a permanent injunction in federal court that would prohibit Amazon from engaging in its unlawful conduct and pry loose Amazon’s monopolistic control to restore competition.

The case rests on shaky grounds

Currently, the enforcement of antitrust law hinges on consumer welfare. That is, anti-trust is only enforced if business conduct is found to be harmful to consumers. Before joining the FTC, however, then-student Commissioner Lina Khan published a paper arguing that the consumer welfare standard is incomplete. As she explained, companies such as Amazon can undertake predatory actions that benefit consumers in the short term but still reduce competition. Such big companies — especially if they act both as seller and online market platforms like Amazon does, should also be assessed on the potential harm they might cause by their dominance in the market.

This reasoning is essentially what is driving the FTC’s splurge of cases against big tech companies. According to the FTC, being big in itself should be scrutinized, even if it does not necessarily hurt consumers, which makes the case against Amazon both frivolous but also significant. Regardless of the outcome of the case, it could have a chilling effect on business mergers and acquisitions, which would only end up hurting consumers.

Take Amazon for instance. The only reason that Amazon has been able to grow to the size it is today is by providing value to consumers, as John Phelan illustrates. Its fast shipping, through its Fulfilment By Amazon (FBA) service especially sets it apart from other online retailers. Amazon is able to offer fast and reliable service at an affordable price making it a consumer favourite. As evidence indicates, due to its sheer size, for example, Amazon is able to negotiate discounts of up to 70 percent with third-party shippers, saving consumers.

And while Amazon does provide a massive consumer base to sellers, it does not necessarily leave them without other options. Numerous other online as well as brick-and-mortar options exist outside of Amazon. These include Target, Walmart, and Best Buy, among others.

By attacking the practices that make Amazon affordable for consumers, the FTC is waging a war on consumers, who have been the biggest benefactor of Amazon’s impressive growth. By looking at the FTC’s own claims and the misleading data that it is using to push the lawsuit, it is easy to see why this is the case.

Prior to 2019, Amazon had an option where sellers could use third-party shippers — called Seller Fulfilled Prime (SFP). That program was scrapped in 2019 but was reintroduced this year. In its criticism of Amazon’s BFA requirement, the FTC claims that sellers who used SFP met their promised delivery date 95 percent of the time. Therefore, according to the FTC, there is no good reason for Amazon to tie Prime eligibility to its BFA service. However, as Reason explains, the 95 percent number refers to delivery dates that sellers set themselves. Sellers who shipped independently, in fact, only met Amazon Prime shipping requirements — of 2 days or less — 16 percent of the time. That is, customers get delayed service when sellers use third-party shippers.

The idea that other companies cannot effectively against Amazon also falls flat on its face when we consider the fact that Amazon is currently facing competition from other Chinese retailers such as Temu and Shein, who are currently clawing at the company’s consumer base. These companies did not need the FTC’s help to undermine Amazon in the marketplace. They just offered cheaper goods.

How the case could hurt consumers

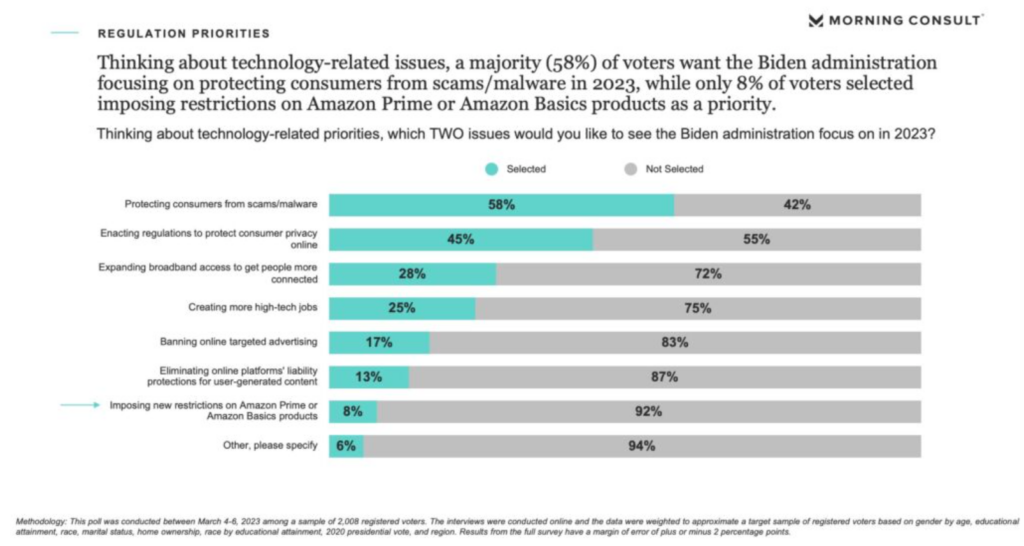

Numerous surveys indicate that customers are generally satisfied with Amazon (and Amazon Prime). Surveys also indicate that consumers do not support efforts to regulate Amazon more stringently. In fact, when A survey conducted by Morning Consult earlier this year asked participants if the Biden Administration should do more to restrict prime, the majority said no. Respondents instead said that the Biden administration should focus its efforts on protecting consumers against scams and malware, and not on regulating Amazon.

Luckily for consumers, the FTC has been on a consistent losing streak. Still, the FTC’s lawsuit sends a strong signal to American companies that growth — even if it comes through offering value to consumers — is bound to be met with skepticism by the FTC. This could be strong enough to discourage innovation and improvement in operating efficiencies. FTC.

Two value that Amazon provides is summed up pretty well especially in this article by two researchers from Mercatus Center. As they explain.

Amazon is a highly efficient, vertically integrated entity whose foray into overlapping business lines—offering a digital marketplace for retailers, its own competing retail products for customers, and a homegrown logistics division for both customers and retailers—creates synergies that have generated immense value for consumers.

Consumers will be the biggest loser if the FTC succeeds in its fight against Amazon.