What the CBO report on income distribution tells us about income inequality in the US

Leaders of the G20 met in Bali, Indonesia for their annual summit last month (Nov. 15-16). Like the past couple of years, growing income inequality was one of the top issues discussed. A representative from Oxfam — an international organization at the forefront of denouncing income inequality — specifically criticized developing countries for not doing much to address ‘extreme’ income inequality.

Granted, the G20 summit mainly focuses on global inequality, but similar sentiments have been expressed repeatedly, including in the United States. Many individuals have been calling doom to the growing inequality and feel that the U.S. is not doing much to address the wealth gap. Instead, most of these individuals and groups call for a wealth tax to reduce inequality. Even millionaires have been calling for higher taxes on the rich.

But are these claims justified? The data seems to show that that’s not the case. In fact, after taking into account the high taxes paid by the rich and transfer payments to the poor, inequality is vastly overstated. Moreover, the federal government already redistributes a lot of income to curb inequality.

Income distribution in 2019

The Congressional Budget Office (CBO) releases a report every year on household income distribution in the United States. And indeed, the most recent report, which has data from 2019, shows that income in the U.S. is distributed unequally among households.

After dividing households into five proportions — called quintiles — the CBO finds that

the average income among households in the highest quintile (or fifth) of the income distribution was 14 times the average income of households in the lowest quintile:

• Average income before means-tested transfers and federal taxes among households in the lowest quintile of the income distribution was about $23,800.

• Average income before transfers and taxes among households in the highest quintile was about $332,100.

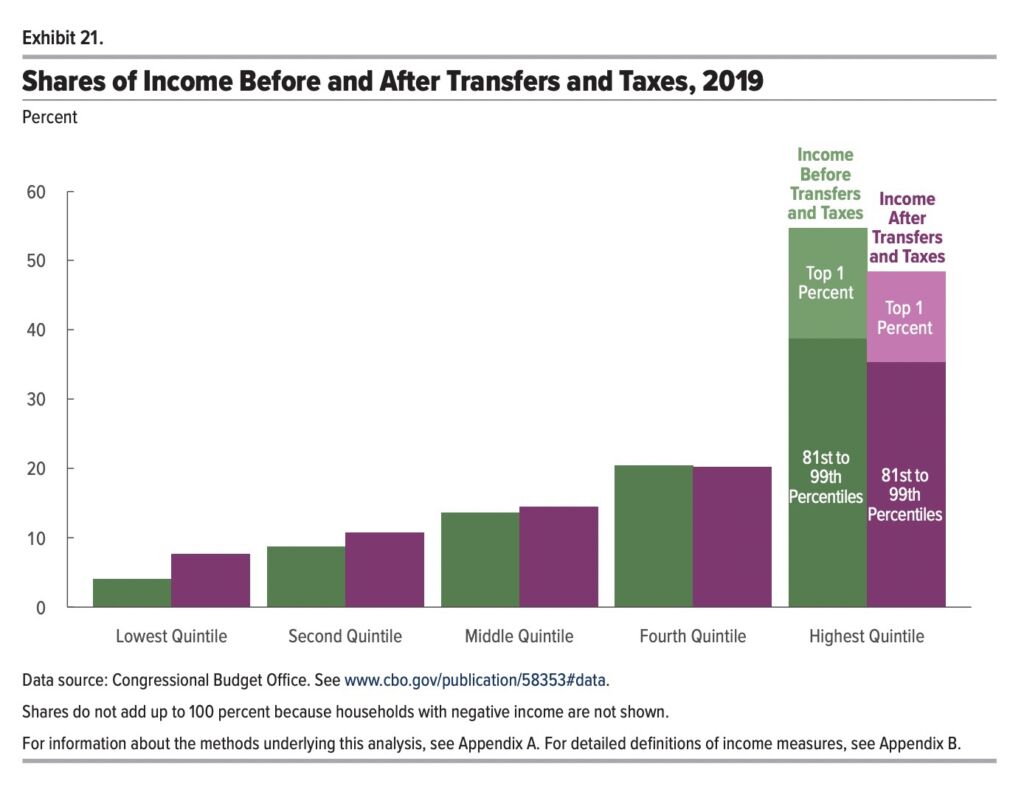

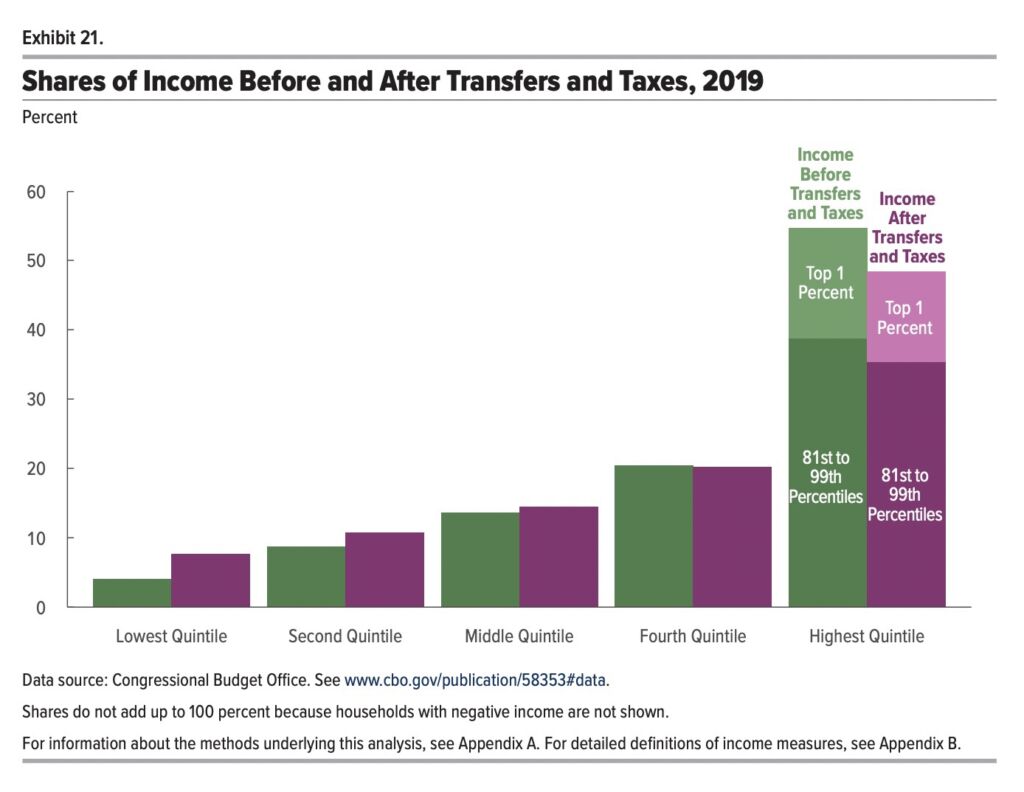

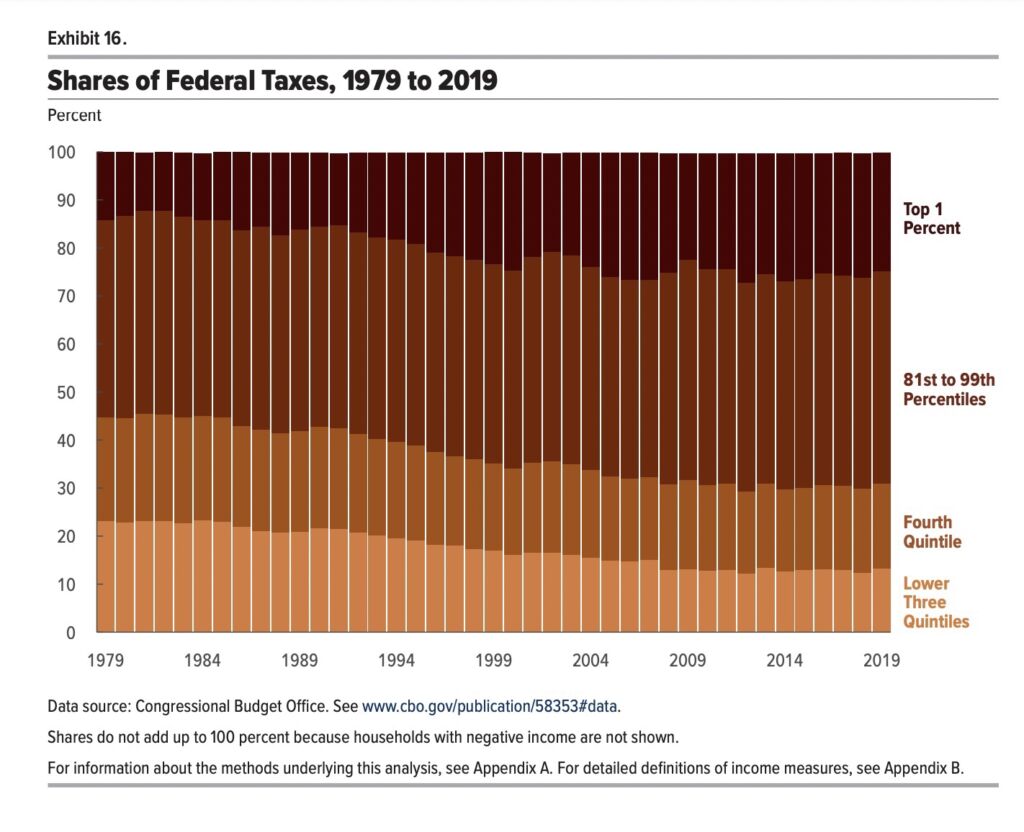

However, the U.S. taxation system is progressive, with high-income earners paying disproportionately more than their share of income. In 2019, individuals in the top income quintile paid 69 percent of all federal taxes despite earning 55 percent of all income. This reduced their income after taking taxes into account.

At the same time, however, households in the bottom income groups pay lower taxes disproportionately benefit from means-tested transfers, which raise their income. In 2019, households in the bottom quintile earned 4 percent of all income, but only paid 0.1 percent of all federal taxes.

In 2019 specifically, these transfers

increased income among households in the lowest quintile by $15,100 (or 64 percent), on average, to $38,900

…while taxes

decreased income among households in the highest quintile by $80,000 (or 24 percent), on average, to $252,100.

Those at the top saw the most significant decline in income due to high taxes. For instance, while those in the 81st to 90th percentile saw their incomes decline by $34,800 on average, the top 1 percent saw a decline of about $600,000, and the top 0.01 percent saw their income drop by $13 million.

Consequently, after taxes and transfers are considered, income for households in the top was only six times — not 14 times — the income of households in the bottom quintile. And while households in the bottom quintile earned 4 percent of income before taxes, they earned 8 percent of all income after taxes and transfers. But those at the top earned 48 percent of income after taxes, down from 55 percent before taxes.

Income growth

Contrary to the popular opinion among some skeptics, the rich are not growing richer while the poor languish. In fact, between 2018 and 2019, low-income households experienced the highest growth rate in income among all income groups.

According to the CBO, income for households in the bottom quintile grew by 7 percent, and that of households in the middle quintile grew by 4 percent. At the top, income grew much slower, with the top quintile experiencing a 1 percent growth. But among those in the top 1 percent, income declined.

And even after accounting for higher taxes and reduced transfers that resulted from this income growth, each of the four bottom quintiles saw income grow between 3 to 4 percent compared to the 2 percent growth experienced by the top quintile.

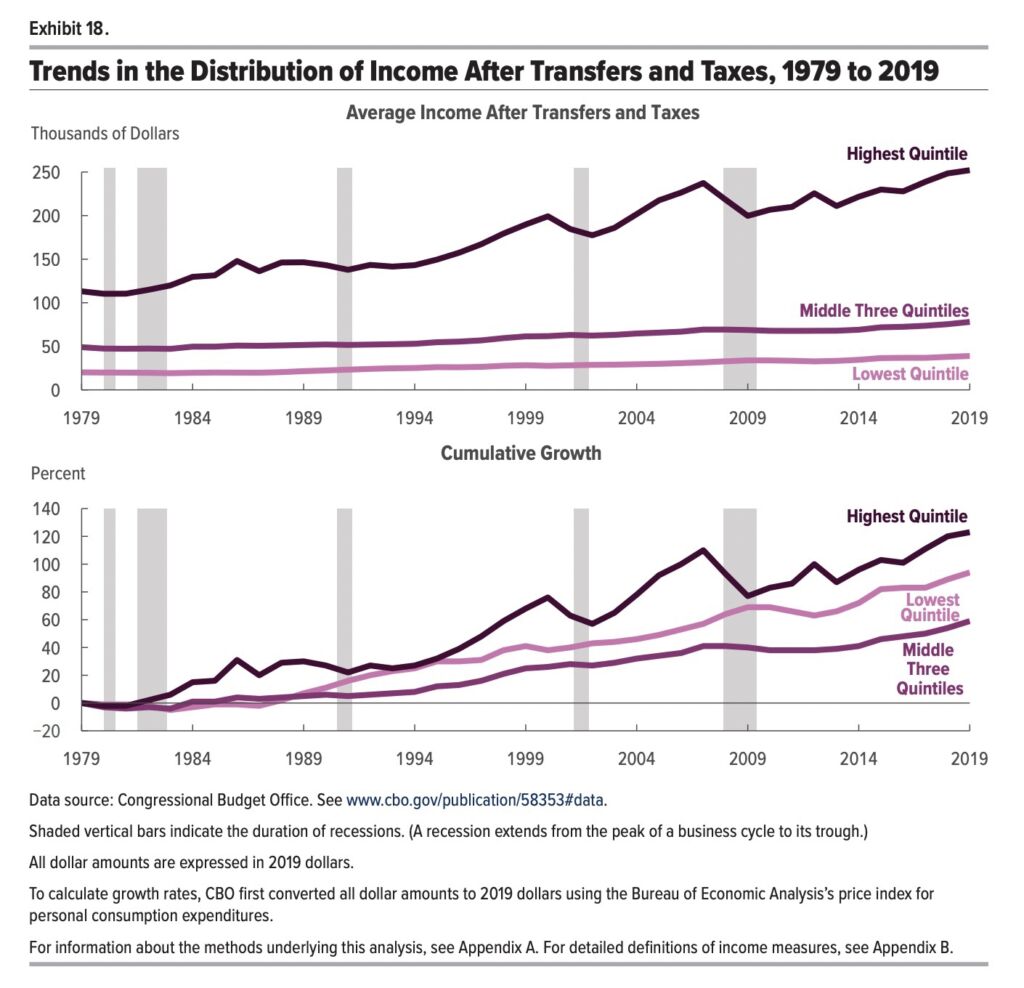

Over the long term, high-income households have seen higher growth in income, but then again, that growth has been tempered by the progressive tax and welfare system.

Between 1979 and 2019, for example, households in the top quintile saw their income grow by 114 percent. In comparison, income for households in the middle three and lowest quintiles saw their incomes rise by just 43 and 45 percent, respectively. But when taxes and transfers are considered, the top quintile grew by 94 percent and the middle three by 59 percent.

| Household income | The cumulative growth in income before (taxes and transfers), 1979 to 2019 | The cumulative growth in income (after taxes and transfers), 1979 to 2019 |

| Lowest Quintile | 45% | 94% |

| Middle three | 43% | 59% |

| top quintile | 114% | 123% |

What the data on inequality shows

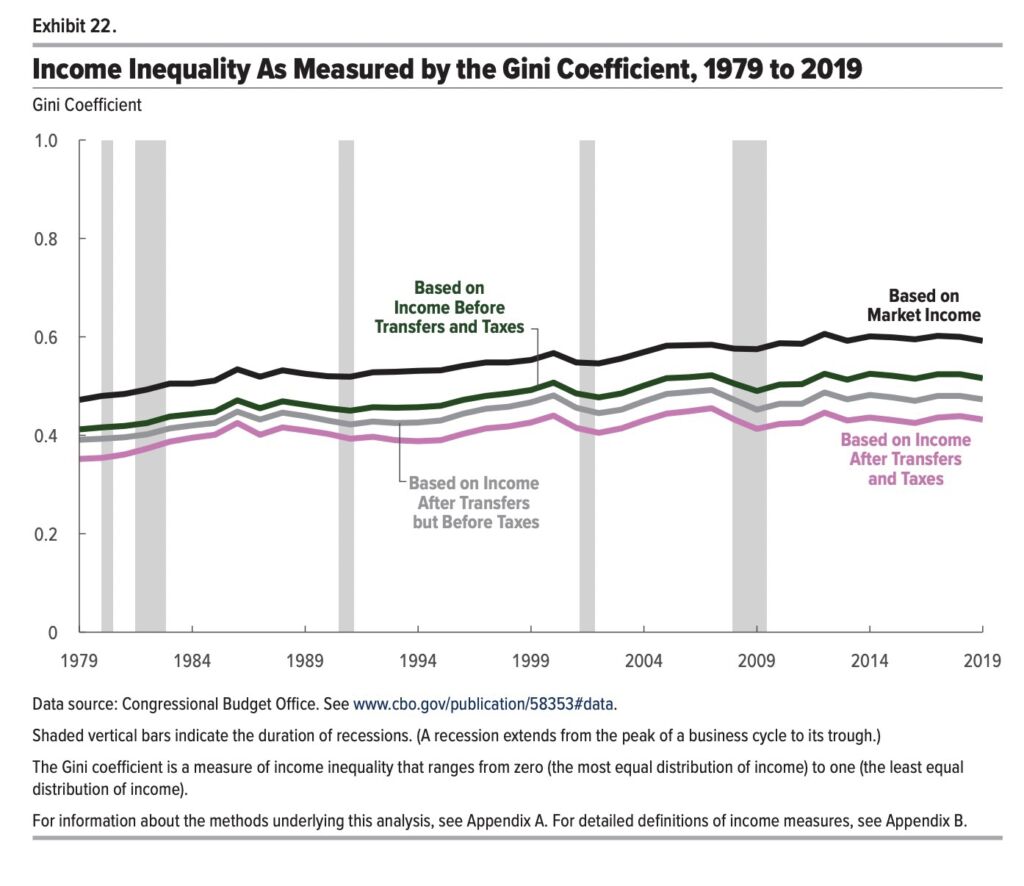

So, while there is inequality in the U.S., it is vastly overstated. Moreover, through a progressive taxation and welfare system, the U.S. government already redistributes a lot of income from the top earners to low-income earners.

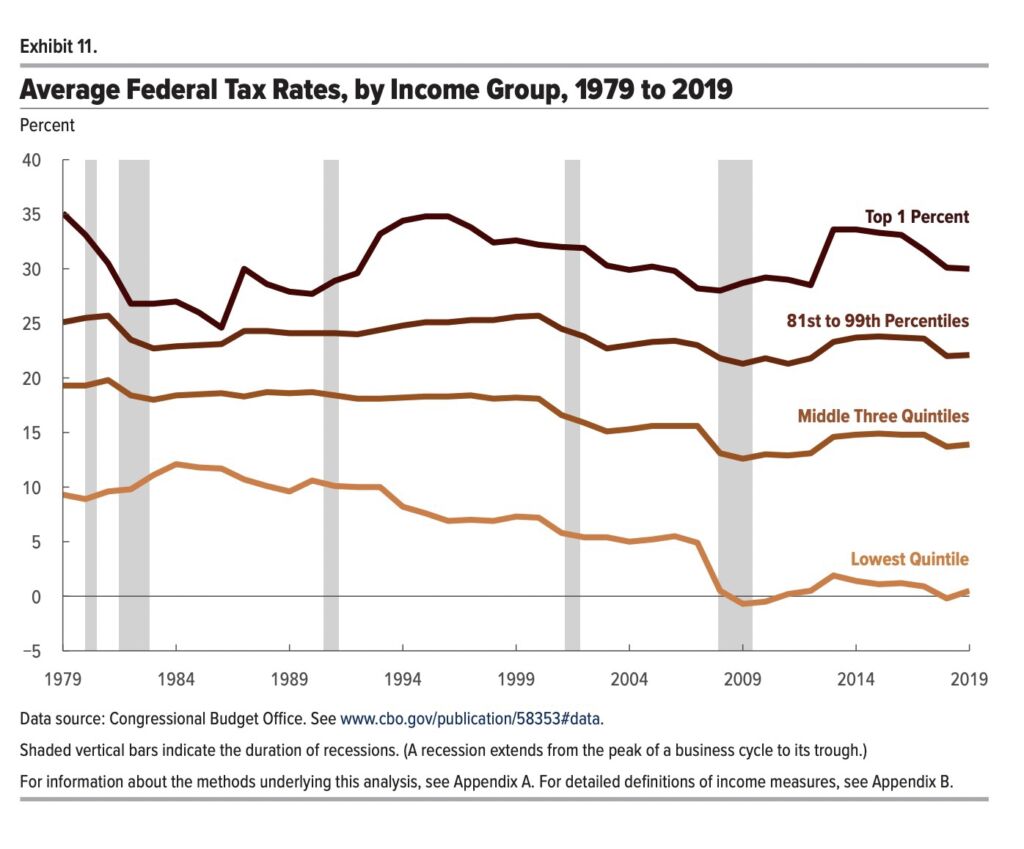

Between 1979 and 2019, the average federal tax rate paid by households in the lowest quintile dropped from about 10 percent to nearly zero. While at the same time, the effective tax rate paid by the top quintile has hovered around 25 percent.

As a result of growing taxes at the top, and growing transfers at the bottom, the share of federal taxes paid by those at the top has gone up over time, while the share of federal taxes paid by those at the bottom has gone down. The top quintile, for example, paid 55 percent of all federal taxes in 1979, but in 2019, they paid 69 percent.

Overall, the data shows that individuals largely overstate how unequal income distribution in the U.S. is and how much that inequality has grown over time. And contrary to opinion, U.S. policy has done much to redistribute income from top to bottom through the welfare and tax system.