How to stop utility green plating: The Only Pay for What You Get Act

A fundamental problem with the vertically integrated monopoly utility model is that utilities can recover the full cost of an asset, plus a five to ten percent rate of return, regardless of whether that asset contributes to grid reliability. Last week, we detailed how this arrangement has allowed utilities to make billions building unreliable wind and solar facilities and the generators to back them up.

This week, we discuss one of our ideas for fixing this situation: the Only Pay for What You Get Act. This legislation would protect electricity customers by only allowing utilities to earn a profit on the reliable portion of a power plant. We believe this change would introduce important market signals to a utility planning process that lacks them.

This article will explain the basics of the legislation and show a real-world example of how, if enacted, it would save ratepayers billions of dollars in costs, provide tangible reliability benefits, and, ideally, dissuade utilities from Green Plating their grids.

Introducing capacity values

Different types of power plants have different operational characteristics and abilities. As a result, each type of power plant offers a different reliability value to the grid during times of peak electricity demand.

These reliability values are known by various names, including accredited capacity, unforced capacity (UCAP), or plain old capacity value. Since all of these metrics basically mean the same thing, they will be used interchangeably in this article.

Grid planners, whether they be state public utility commissions or Regional Transmission Organizations (RTOs), use these capacity values to determine whether there are enough reliable power plants on their system to meet their projected peak demand, plus a margin of safety. These exercises are referred to as Resource Adequacy (RA) studies.

As you might imagine, dispatchable plants that can be turned on to produce electricity when needed—coal, natural gas, nuclear, hydroelectric, and battery storage— receive higher capacity values than intermittent resources like wind or solar, which only generate electricity when the wind is blowing, or the sun is shining.

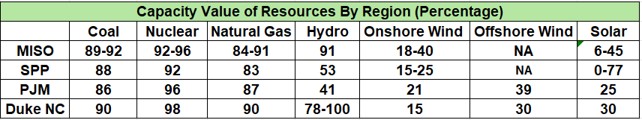

The table below shows the capacity values given by some of the major American RTOs and Duke Energy in North Carolina.

Thermal resources—coal, nuclear, and natural gas— tend to get steady capacity values, and wind and solar receive a range of capacity values based on the amount of wind and solar capacity currently present on a system, and their seasonal performance.

Under the Only Pay for What You Get Act, utilities would only be able to earn a profit on the reliable portion of the asset. This portion would be high for coal, nuclear, and natural gas and lower for wind and solar to reflect the lower reliability value they provide to ratepayers. Doing so would also bring the incentives of ratepayers and shareholders into better alignment.

How “Only Pay” would work in North Carolina

In 2022, we modeled the cost and reliability impacts of Duke Energy’s Carolina Carbon Plan on behalf of the John Locke Foundation. Duke proposed four energy resource portfolios to meet the carbon-free requirements enacted by H.B. 951.

Duke proposed four different portfolios with varying amounts of new onshore wind, offshore wind, solar, battery storage, pumped hydroelectric storage, nuclear, and natural gas capacity to replace the retiring coal fleet.

The company has since updated its proposals on multiple occasions, but our 2022 analysis is still useful because it shows how Only Pay for What You Get would protect ratepayers from paying for assets with a low capacity value.

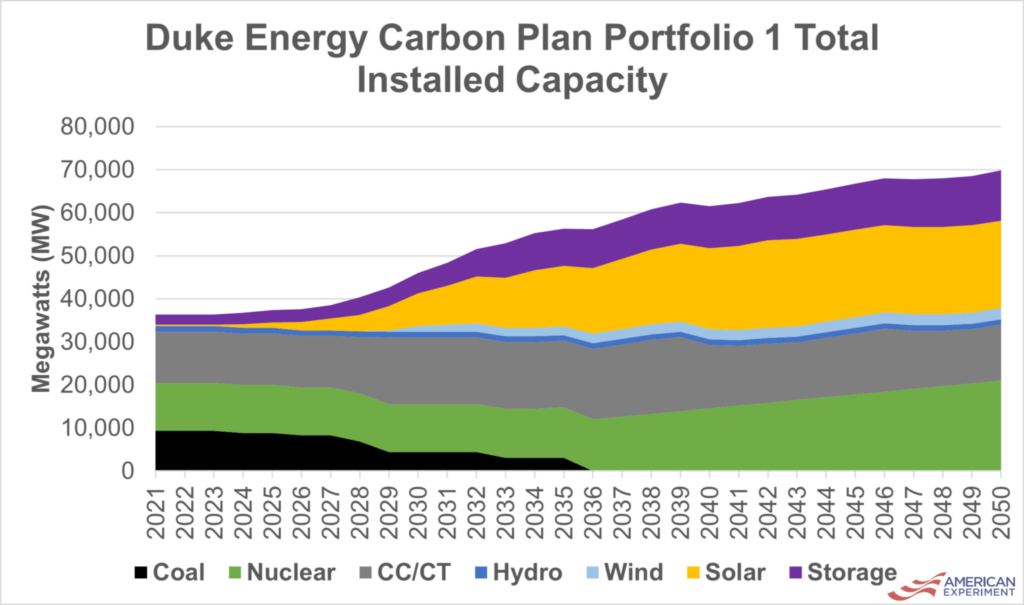

From 2021 through 2050, Duke’s Portfolio 1 (P1) would retire 9,300 MW of coal and build 19,900 MW of standalone solar and solar plus storage, 1,800 MW of onshore wind, 800 MW of offshore wind, 7,400 MW of battery storage, 2,400 MW of combined cycle natural gas, 6,800 MW of “hydrogen ready” natural gas combustion turbine capacity, 9,900 MW of nuclear, and 1,700 MW of pumped storage, shown in the graph below.

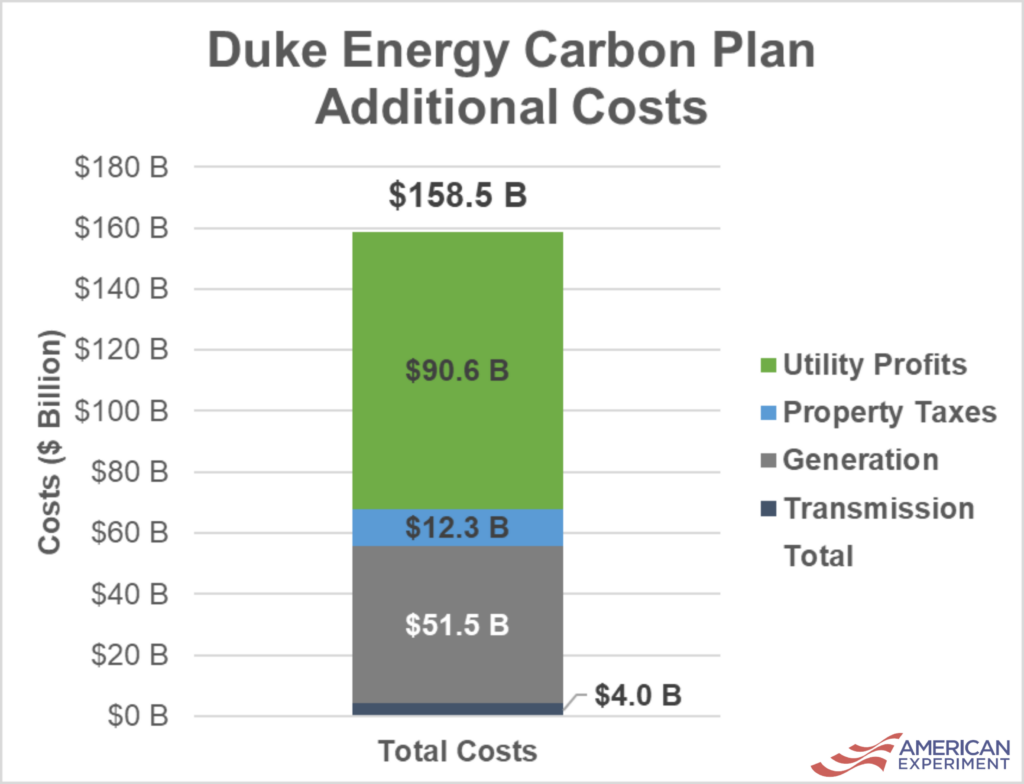

We calculated that this portfolio would cost $158.5 billion through 2050. Surprise! The largest expenses consist of $90.6 billion in utility profits, followed by $51.5 billion in additional generation costs, $4 billion in transmission expenses, and $12.3 billion in additional property tax expenses, shown in the graph below.

The bulk of utility profits are earned on new nuclear plants, solar installations, battery storage facilities, and wind facilities.

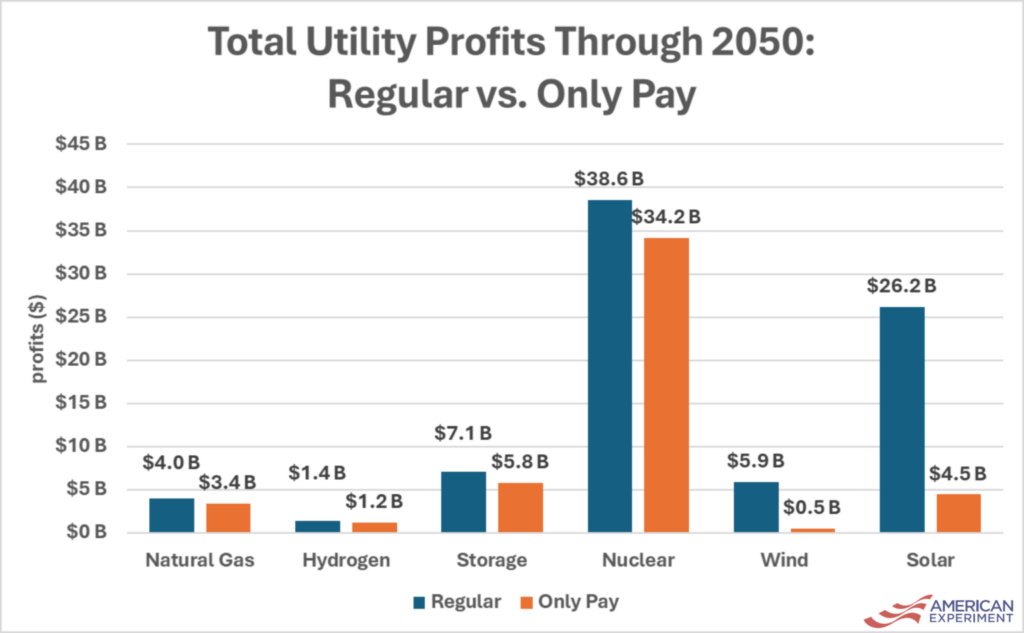

Under Only Pay, the utility profits would shift substantially, as Duke would only be able to recover 30 percent of the cost of solar, 15 percent for its onshore wind facilities, 30 percent for its offshore wind facilities, 90 percent for storage, and 90 percent for its thermal power plants.

As a result, utility profits would drop by 28 percent to $65.3 billion through 2050, assuming Duke built the same amount of capacity for each energy source. In all likelihood, Duke and other utilities would choose to build more reliable generators given the new incentive structure created by Only Pay.

The graph below shows how Only Pay would impact utility profits by energy source through 2050. Profits earned on building 9,900 MW of nuclear would fall from $38.6 billion to $34.2 billion, reflecting nuclear’s high capacity value. Profits from building 19,900 MW of solar and solar plus storage would fall from $26.2 billion to $4.5 billion due to solar’s lower capacity value, and onshore and offshore wind profits would fall from $5.9 billion to $0.5 billion, resulting in substantial savings for North Carolina electricity consumers.

It is important to note that Only Pay would not prevent any company from building wind or solar, but it would protect ratepayers from paying billions of additional dollars for assets that may not show up when needed most (see more below).

Some of the financial risks for building these resources would be shifted from electricity customers to the company’s shareholders, or the company could offer voluntary subscription services for customers who want to pay for wind and solar while keeping costs lower for those who don’t.

Tangible reliability benefits

Only Pay would also increase the reliability of the power system by incentivizing utilities to build dispatchable nuclear and natural gas resources while making intermittent wind and solar less attractive.

This is an important aspect to consider because North Carolina has a winter peaking system. Winter peak electricity demand generally stems from home heating, which almost always occurs at night when temperatures are lowest and the sun isn’t shining.

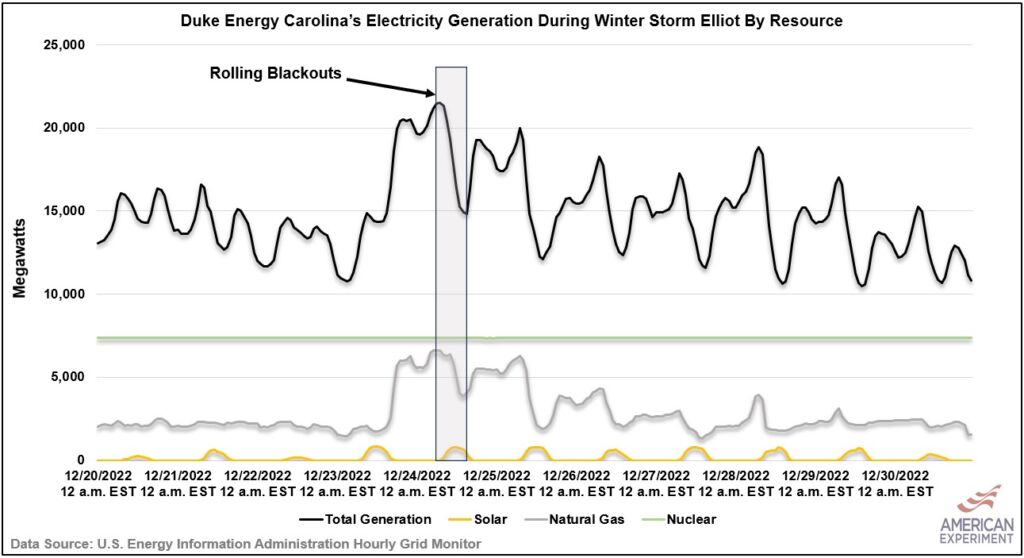

For example, the graph below shows real-time electricity demand and generation from solar, natural gas, and nuclear power plants in North Carolina during the week of Winter Storm Elliot. Approximately 15 percent of Duke’s customers—roughly 500,000 in total—experienced rolling blackouts, which were the company’s first blackouts in its history of operation in North Carolina.

On the evening of December 23rd through the morning of December 24th, electricity demand peaks twice, once just after sunset and again just before sunrise. According to a presentation by Duke Energy, the company initiated the first rolling outages around 6 a.m. on the 24th when demand peaked and there was no solar operating on its system, and restored power around 4 p.m.

The lack of solar wasn’t the sole cause of the blackouts—the company experienced several unit derates and outages at some of its coal and natural gas facilities—but solar, by definition, will not be available during future winter peaking events that will only become larger if the state experiences growing electricity demand for a growing population and vehicle electrification.

By encouraging utilities to build more reliable and dispatchable nuclear and natural gas power plants on their systems, Only Pay will help prevent power outages caused by the inherent weaknesses of intermittent generation resources like wind and solar, which are currently the darling technologies of the energy transition.

Conclusion

Electricity prices are soaring across the country because utilities are shutting down low-cost, depreciated power plants that provide the most reliable and affordable electricity to the families and businesses that rely upon it.

Ratepayers would benefit most from the continued operation of these existing power plants, but the onslaught of state policies mandating carbon-free electricity, federal Environmental Protection Agency (EPA) regulations, and the current incentive structure of monopoly utilities mean many, if not most, of these power plants will be shut down in the coming decades.

We believe the Only Pay For What You Get Act would create better alignment between the incentives of utilities and their customers by encouraging utilities to build reliable assets like new nuclear and natural gas plants, ensuring electricity customers are getting the best value for their dollars and that utilities are building the dispatchable power plants needed to deliver power during periods of peak demand.

We have draft legislation for Only Pay available if you believe lawmakers in your state would be interested in introducing it.